About the fund

Tata Quant Fund is a quant model-based Fund which uses internally developed machine learning based model to make investment decisions.

The Fund is an active multi factor investment model. Embedded with Artificial Intelligence modules that dynamically change factor strategies basis prevailing market conditions.

Why Tata Quant Fund?

AI & Machine learning enables analysing humongous data & take informed decisions

Automatic machine-led investing helps remove human & rule-based investing biases

Model-based optimal stock selection, allocation & periodic rebalancing

Improves diversification and manages risk

Adheres to fund mandate with the help of emotion-free investing

Learns, relearn & adapts to market conditions

How it works?

Select Universe of Stocks

Automatically selects stocks out of universe of BSE 200 stocks and equity derivatives

Create Factor Portfolios

Build portfolios basis of multiple factors viz, market capitalization, value, quality and momentum

Estimate Market Direction

Weigh up market scenario and analyses it

Predict the out performing Portfolio

Predict the factor combination that will outperform in forthcoming month

Up: Equity long position

Down: Hedged position

Depending on prevailing market condition it recommends whether to buy or hedge

How it works?

Who should invest?

Those who believe in Artificial Intelligence & Machine Learning driven new age investing world

Patient investors with investment horizon of 5-7 years

Those who want to make the most of bias-free investing and get optimal returns in the long run

Scheme Details

| Scheme Name | Tata Quant Fund |

| NFO Dates | NFO OPENS: 3rd January, 2020 NFO CLOSES: 17th January, 2020 |

| Investment Objective | The Investment objective of the scheme is to generate medium to long-term capital appreciation by investing in equity and related instruments elected based on a quantitative model(Quant Model) However, there is a no assurance or guarantee that the investment objective of the Scheme will be achieved. The scheme does not assured or guarantee any returns. |

| Type of Scheme | An open-ended equity scheme following quant-based investing theme |

| Fund Manager | Sailesh Jain |

| Benchmark | S & P BSE 200 TRI |

| Min. Investment Amounts | Rs. 5,000/- and in multiple of Re.1/- thereafter. Additional Investment: Rs. 1,000/- and in multiple of Re.1/- thereafter. |

| Load Structure |

Entry Load(During NFO): N.A. Exit Load: 1% of the applicable NAV, if redeemed/switched out on or before expiry of 365 days from the date of allotment. |

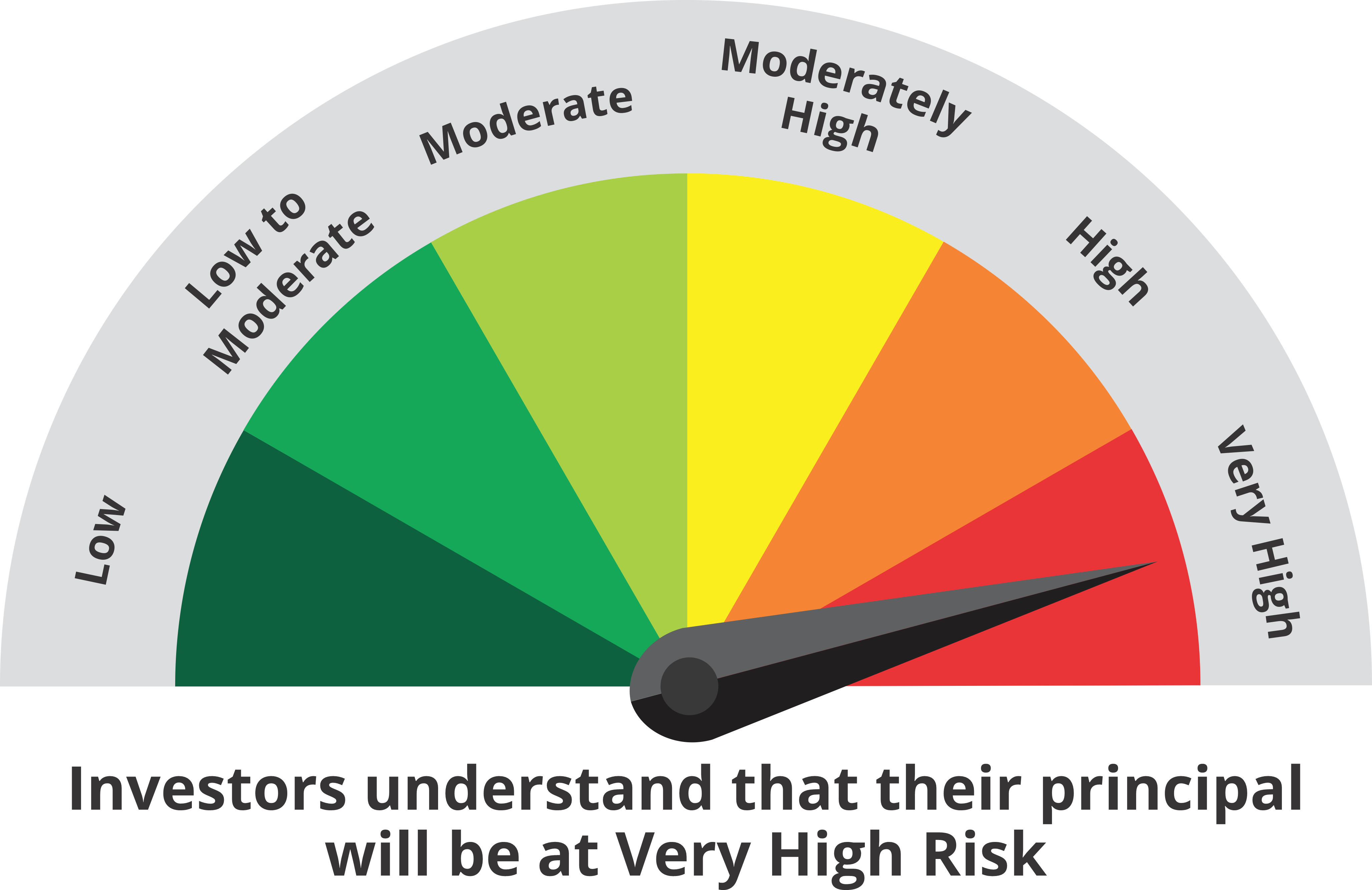

Tata Quant Fund is suitable for investors who are seeking*:

- Medium to Long Term Capital Appreciation.

- Investment in equity & equity related instruments selected based on quant model

*Investors should consult their financial advisors if in doubt about whether the product is suitable for them

Mutual fund investments are subject to market risks, read all scheme related documents carefully.

Model Risk: Investment strategy of Quant Funds are essentially rule-based, driven by algorithms developed basis historical relations of multiple factors with stock price movements. One of the risks in a quant-based model would be the time taken by the algorithm to adapt to new developments or change in how certain factors influence market or stock dynamics. The success of the model is based on systematic investment approach and therefore it may not be able to leverage short term opportunities available in the market from time to time. Another risk that can emanate from a rule based systematic investment strategy would be the inability to perfectly time the market which might impact performance of the fund in the short term. There is no guarantee that the Quant model will generate higher returns as compared to the benchmark

Corporate Office Address:

Tata Asset Management Private Limited, 19th floor, Parinee Crescenzo, ‘G’ Block, Bandra Kurla Complex, Opposite MCA Club, Bandra (E), Mumbai – 400051